All Categories

Featured

2 individuals purchase joint annuities, which offer a surefire revenue stream for the rest of their lives. If an annuitant passes away during the distribution duration, the remaining funds in the annuity may be passed on to a marked recipient. The certain choices and tax obligation ramifications will depend upon the annuity contract terms and suitable legislations. When an annuitant dies, the interest earned on the annuity is managed differently depending on the sort of annuity. With a fixed-period or joint-survivor annuity, the interest continues to be paid out to the enduring beneficiaries. A death advantage is an attribute that guarantees a payout to the annuitant's recipient if they die prior to the annuity payments are worn down. The accessibility and terms of the death advantage may differ depending on the specific annuity agreement. A kind of annuity that quits all repayments upon the annuitant's death is a life-only annuity. Comprehending the terms and problems of the survivor benefit prior to purchasing a variable annuity. Annuities undergo taxes upon the annuitant's death. The tax obligation therapy depends upon whether the annuity is held in a qualified or non-qualified account. The funds undergo revenue tax obligation in a qualified account, such as a 401(k )or IRA. Inheritance of a nonqualified annuity generally results in taxation only on the gains, not the whole amount.

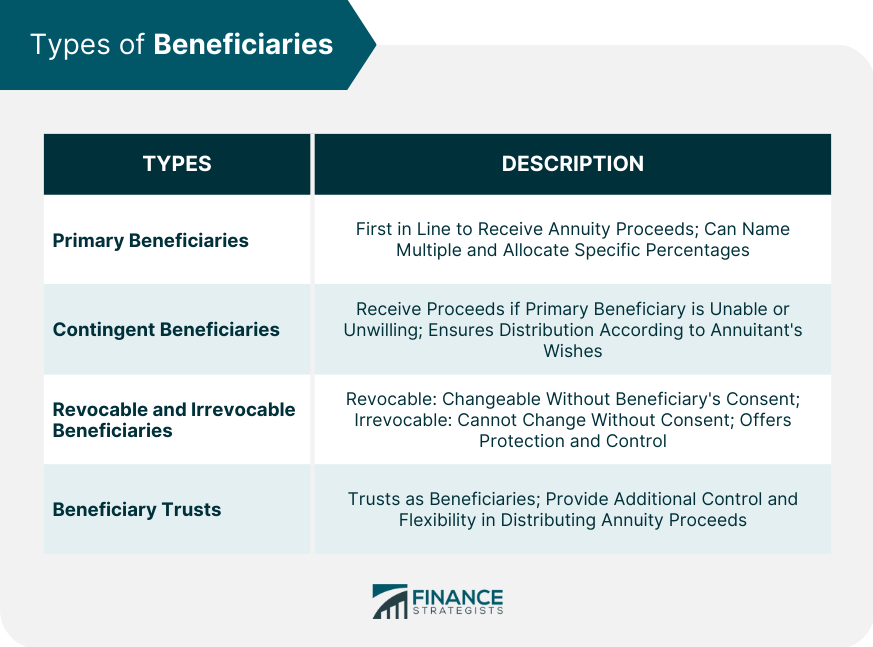

If an annuity's assigned recipient passes away, the result depends on the details terms of the annuity contract. If no such recipients are assigned or if they, too

have passed have actually, the annuity's benefits typically revert normally go back annuity owner's estate. If a beneficiary is not called for annuity benefits, the annuity proceeds generally go to the annuitant's estate. Annuity beneficiary.

Are inherited Annuity Withdrawal Options taxable income

Whatever portion of the annuity's principal was not currently tired and any type of revenues the annuity collected are taxed as income for the recipient. If you acquire a non-qualified annuity, you will just owe tax obligations on the earnings of the annuity, not the principal used to purchase it. Since you're obtaining the whole annuity at once, you must pay taxes on the entire annuity in that tax year.

Latest Posts

Highlighting the Key Features of Long-Term Investments A Closer Look at Pros And Cons Of Fixed Annuity And Variable Annuity Defining the Right Financial Strategy Benefits of Choosing Between Fixed Ann

Breaking Down Choosing Between Fixed Annuity And Variable Annuity Key Insights on Your Financial Future What Is Retirement Income Fixed Vs Variable Annuity? Advantages and Disadvantages of Fixed Incom

Breaking Down Fixed Vs Variable Annuities Everything You Need to Know About Financial Strategies Defining the Right Financial Strategy Features of Annuities Fixed Vs Variable Why Variable Annuities Vs

More

Latest Posts