All Categories

Featured

Table of Contents

Area 691(c)( 1) provides that a person who consists of an amount of IRD in gross revenue under 691(a) is allowed as a deduction, for the exact same taxable year, a section of the inheritance tax paid because the addition of that IRD in the decedent's gross estate. Typically, the quantity of the deduction is determined using estate tax worths, and is the amount that bears the same proportion to the estate tax obligation attributable to the internet value of all IRD products consisted of in the decedent's gross estate as the value of the IRD included because person's gross earnings for that taxed year bears to the value of all IRD products included in the decedent's gross estate.

Rev. Rul., 1979-2 C.B. 292, addresses a situation in which the owner-annuitant purchases a deferred variable annuity contract that supplies that if the proprietor dies prior to the annuity starting day, the named recipient may choose to get the present accumulated value of the contract either in the kind of an annuity or a lump-sum payment.

Rul. If the recipient elects a lump-sum repayment, the excess of the quantity got over the quantity of consideration paid by the decedent is includable in the beneficiary's gross revenue.

Rul. Had the owner-annuitant gave up the contract and obtained the amounts in unwanted of the owner-annuitant's investment in the contract, those quantities would have been earnings to the owner-annuitant under 72(e).

Fixed Annuities inheritance and taxes explained

In the present case, had A surrendered the agreement and obtained the amounts at problem, those amounts would have been earnings to A under 72(e) to the degree they went beyond A's financial investment in the contract. As necessary, amounts that B gets that surpass A's financial investment in the contract are IRD under 691(a).

Rul. 79-335, those amounts are includible in B's gross earnings and B does not get a basis adjustment in the agreement. B will be qualified to a reduction under 691(c) if estate tax obligation was due by factor of A's fatality. The outcome would certainly be the same whether B obtains the fatality advantage in a round figure or as periodic payments.

The holding of Rev. Rul. 70-143 (which was revoked by Rev. Rul. 79-335) will certainly continue to make an application for deferred annuity contracts acquired prior to October 21, 1979, consisting of any kind of contributions related to those agreements according to a binding dedication participated in before that day - Multi-year guaranteed annuities. PREPARING INFORMATION The principal author of this revenue judgment is Bradford R

Q. How are annuities strained as an inheritance? Is there a distinction if I acquire it straight or if it mosts likely to a count on for which I'm the beneficiary?-- Planning aheadA. This is a terrific concern, but it's the kind you should take to an estate planning attorney who recognizes the information of your situation.

What is the connection between the departed owner of the annuity and you, the recipient? What type of annuity is this? Are you asking about earnings, estate or estate tax? We have your curveball question about whether the outcome is any different if the inheritance is via a trust or outright.

Let's start with the New Jacket and federal estate tax effects of inheriting an annuity. We'll assume the annuity is a non-qualified annuity, which implies it's not component of an IRA or other competent retirement plan. Botwinick claimed this annuity would be included in the taxed estate for New Jersey and government estate tax obligation functions at its date of death worth.

Inherited Annuity Fees tax liability

person partner surpasses $2 million. This is known as the exemption.Any amount passing to an U.S. resident partner will be completely excluded from New Jacket estate tax obligations, and if the proprietor of the annuity lives throughout of 2017, after that there will certainly be no New Jacket estate tax on any type of quantity because the inheritance tax is scheduled for abolition starting on Jan. There are government estate taxes.

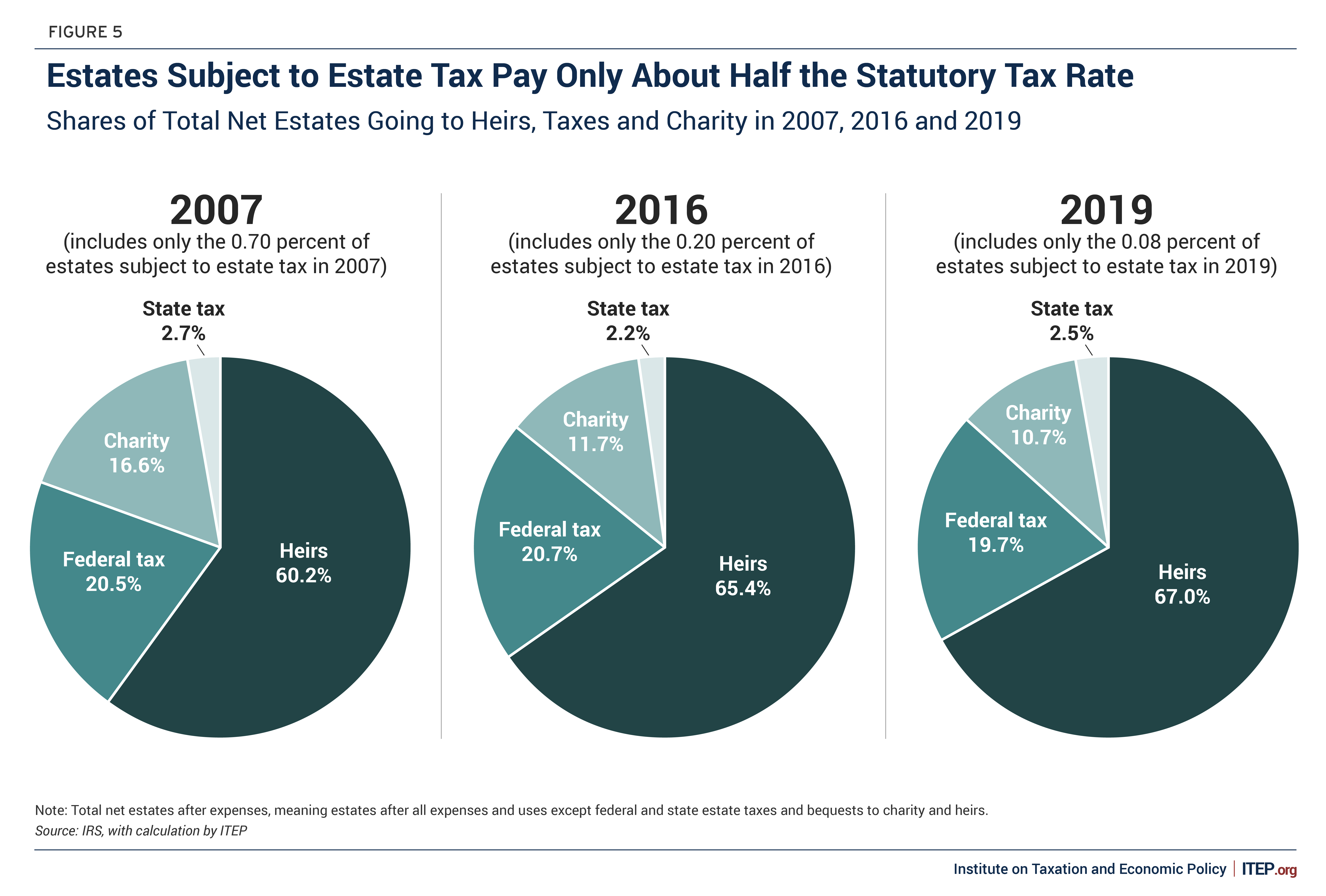

"Currently, earnings taxes.Again, we're assuming this annuity is a non-qualified annuity. If estate tax obligations are paid as an outcome of the inclusion of the annuity in the taxable estate, the beneficiary might be entitled to a deduction for acquired income in respect of a decedent, he claimed. Beneficiaries have multiple options to think about when choosing just how to receive money from an acquired annuity.

Table of Contents

Latest Posts

Highlighting the Key Features of Long-Term Investments A Closer Look at Pros And Cons Of Fixed Annuity And Variable Annuity Defining the Right Financial Strategy Benefits of Choosing Between Fixed Ann

Breaking Down Choosing Between Fixed Annuity And Variable Annuity Key Insights on Your Financial Future What Is Retirement Income Fixed Vs Variable Annuity? Advantages and Disadvantages of Fixed Incom

Breaking Down Fixed Vs Variable Annuities Everything You Need to Know About Financial Strategies Defining the Right Financial Strategy Features of Annuities Fixed Vs Variable Why Variable Annuities Vs

More

Latest Posts